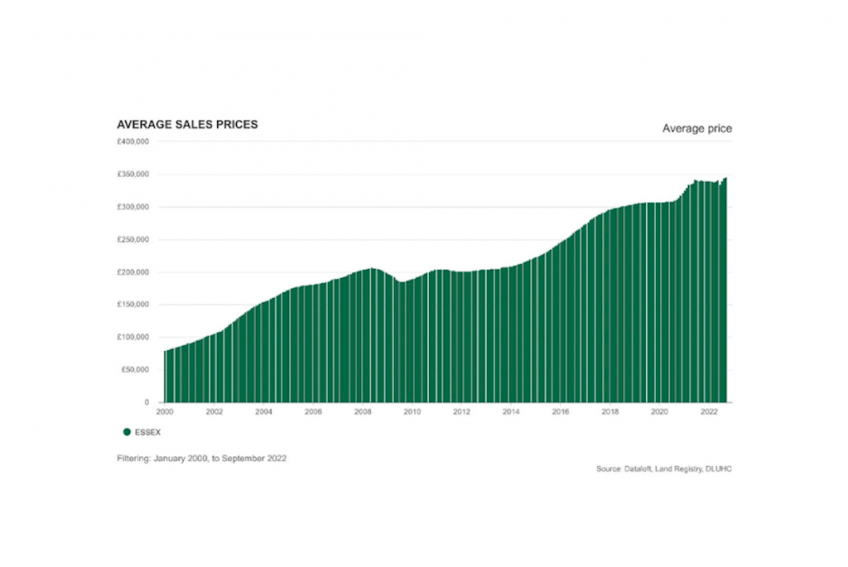

Mel Cindil from Beresfords looks at what 2023 has in store for the housing market …

We have recently been asked to respond to media queries regarding the current state of the housing market, with the most common question being ‘is now a good time to move?’

A recent poll published by Zoopla and Hometrack showed that the average time between buying and then selling a property for homeowners in Britain is 23 years. Whilst there are too many variables in the short term to accurately predict minor price fluctuations, history tells us that long term, property remains one of the safest and most stable investments available.. The common saying in investing is, don’t try to time the market, so below we have looked back on buying scenarios over recent years in trying to answer the many questions asked.

The 23-year scenario

Twenty-three years ago, back in 1999, the average price of property in Essex was £71,986. Fast forward to October 2022 and the average price for those same properties jumps by 380.98% to £346,244 representing an increase of £274,250. Of course, it is difficult to know if you will indeed live in your next home for over 20 years – but if you do then history says that you can expect your home to show a significant increase in value.

One of the biggest falls in UK house prices in recent memory was brought about by the financial crash of 2007-2009, which occurred because of deregulation in the financial industry and mortgage brokers in particular. Indeed, 2008 saw the biggest recession since World War II, with house prices dropping significantly from the previous bubble of 1999-2007 which saw an average property price in Essex rise from £71,986 in January 1999 to £206,659 in July 2008 and represented a 182.41% increase in value.

The 2008 Scenario

(All prices quoted are average prices in Essex, UK).

If you purchased a property at the height of the market in July 2008 at the price of £206,659 and then sold it in August 2009 for £183,385, you would have seen a decrease in value of 11.262%.

However, if you then lived in that property for five years, which is still well below the national average, then the property would have risen by August 2013 to £222,384 already demonstrating an increase of 7.5%.

If you bought a property in 2009 at £183,385 and sold it 6 years later then your property would have increased by 48.49% to £272,321.

Similarly, if you purchased a property in 2016 when the average property price in Essex was £246,839 and sold in September 2022, you would have seen a price achieved of £346,224 on the average prices having secured a 40.26% increase in value equating to nearly £100,000!

So, should you buy now?

First and foremost, a property is a home. People move for larger space, relocation, change of career and many other reasons. Where else can you enjoy something that is essential to your comfort and wellbeing and at the same time see substantial increases over a period of time? There is no question that we live in a county that is extremely sought after and continues to see a growing population with an under-supply of housing stock available. Therefore, due to those factors, property prices will continue to see positive growth in the long term.

Below you will find average property prices in Essex every January since the year 2000.

2000 – £80,372; 2001 – £91,905; 2002 – £106,257; 2003 – £131,602; 2004 – £155,251

2005 – £173,790; 2006 – £181,540; 2007 – £190,998; 2008 – £204,222; 2009 – £197,788

2010 – £189,589; 2011 – £204,818; 2012 – £201,104; 2013 – £204,464; 2014 – £209,548

2015 – £223,472; 2016 – £246,839; 2017 – £274,323; 2018 – £296,909; 2019 – £305,095;

2020 – £307,145 2021 – £325,442; 2022 – £340,048

Are you looking to move? Contact Beresfords today for a free valuation on 01245 397499.