Landons Solicitors in Brentwood has issued the following message for all of its customers.

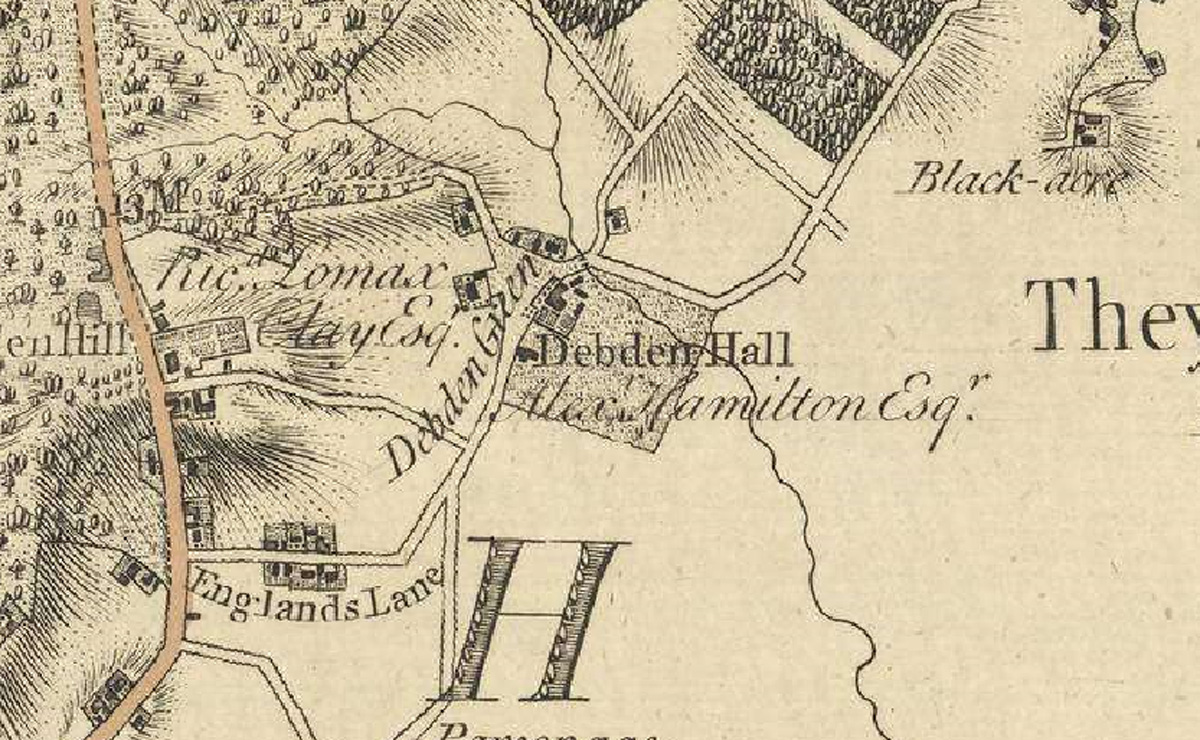

Whilst Landons’ doors remain open, like you all, we await the 5pm daily announcements to determine whether our work will continue in our office or at home. Regardless, Landons Solicitors has looked after our community for the last 170 years and will continue to do so, in whatever capacity or location this may be.

All of our Solicitors are now taking telephone appointments and we encourage you to call us to talk about your Wills, Lasting Powers of Attorney or to discuss any other legal arrangements you may wish to implement or advice you wish to receive. We will, as always, do whatever we can to help individuals, families and businesses within our community.

For now, please all business owners, keep note of what the government are doing to help at this current time;

- a Coronavirus Job Retention Scheme – HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of £2,500 per month for ALL UK business

- deferring VAT and Income Tax payments – the deferral will apply from 20 March 2020 until 30 June 2020 – working similarly to an interest free loan for ALL UK businesses. For Income Tax Self-Assessment, payments due on the 31 July 2020 will be deferred until the 31 January 2021 for ALL those self-employed

- a Statutory Sick Pay relief package for small and medium sized businesses

- a 12-month business rates holiday for all retail, hospitality, leisure and nursery businesses in England for example to shops, restaurants, cafes, drinking establishments, cinemas and live music venues… This will apply to next council tax bills in April 2020.

- small business grant funding of £10,000 for all business in receipt of small business rate relief or rural rate relief

- grant funding of £25,000 for retail, hospitality and leisure businesses with property with a rateable value between £15,000 and £51,000

- the Coronavirus Business Interruption Loan Scheme offering loans of up to £5 million for SMEs through the British Business Bank – the scheme is now open

- a new lending facility from the Bank of England to help support liquidity among larger firms, helping them bridge coronavirus disruption to their cash flows through loans

- the HMRC Time To Pay Scheme – all businesses and self-employed people in financial distress, and with outstanding tax liabilities, may be eligible to receive support with their tax affairs

Above all, take good care and enjoy your homes.

With our best wishes

All at Landons